how to file back taxes without records canada

Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals. However this is only the.

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

You can also order a tax return or tax.

. So although your tax returns are usually subject. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months.

You cant file a return. CANADA WIDE TAX HELP LINE. However to properly use tax accounting software and learn how to file back taxes without records.

Youll need to have handy your Social Security number or individual taxpayer. The longer you go without filing. How Long To Keep Tax Records Business Documents Blue Pencil.

How Long Should I Keep. How to file back taxes without records. For most business owners the best and fastest way to get your tax transcripts is through the Get Transcript Online tool from the IRS.

Put your Documents in Order. Read the article to learn how to file back taxes without records. Prepare the tax return from the clients documents.

How far back can you go to file taxes in Canada. If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040. How to file back taxes without records canada Wednesday June 15 2022 Edit.

The penalty for filing taxes late is 5. Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A. 230 states that you must retain all books and records for six years after the date the tax return is filed.

The more information you get concerning the Canadian tax system the better for you and your finances. You dont have to be told there will be a. To file your taxes enter your information through the automated phone line.

Taxpayers can file back taxes for as many years as they are behind Lacy says. This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit information on all of these years. How to File Back Taxes in Canada TaxWatch Canada LLP.

Invited people with a low or fixed income and a simple tax situation. In the Income Tax Act s. You can still save yourself from IRS penalties if you have missing or incomplete tax records.

Its easiest to pay every month to avoid a. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for.

You will need records in order to file your past-due tax. How to file back taxes without records canada Thursday September 1 2022 Edit.

Tax Prep Documents Checklist H R Block

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

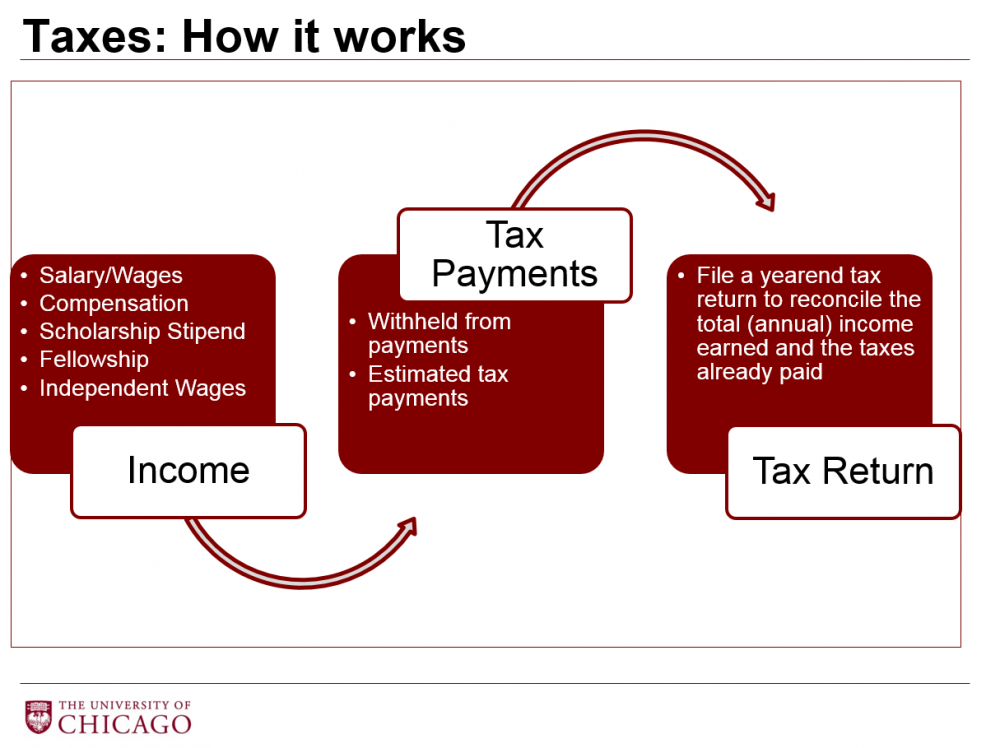

Tax Responsibilities For International Students And Scholars The Office Of International Affairs The University Of Chicago

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Record 269 5bn Green Issuance For 2020 Late Surge Sees Pandemic Year Pip 2019 Total By 3bn Climate Bonds Initiative

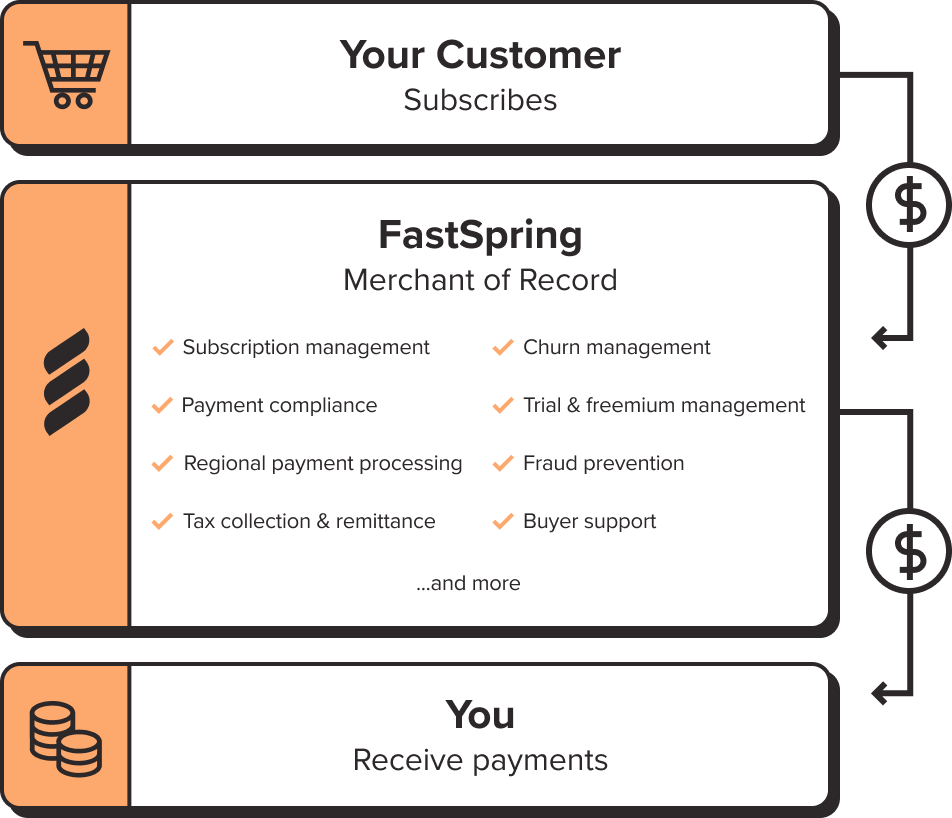

Global Taxes Financial Services Fastspring

How To File A Late Tax Return In Canada

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Tax Return How To File International Students In Canada Simple Tax I Got 2900 Refund Youtube

What You Need To Know This Tax Season And How To Plan For The Next One Cbc News

Negative Income Tax Explained Mit Sloan

Global Taxes Financial Services Fastspring

Stripe Tax Automate Tax Collection On Your Stripe Transactions

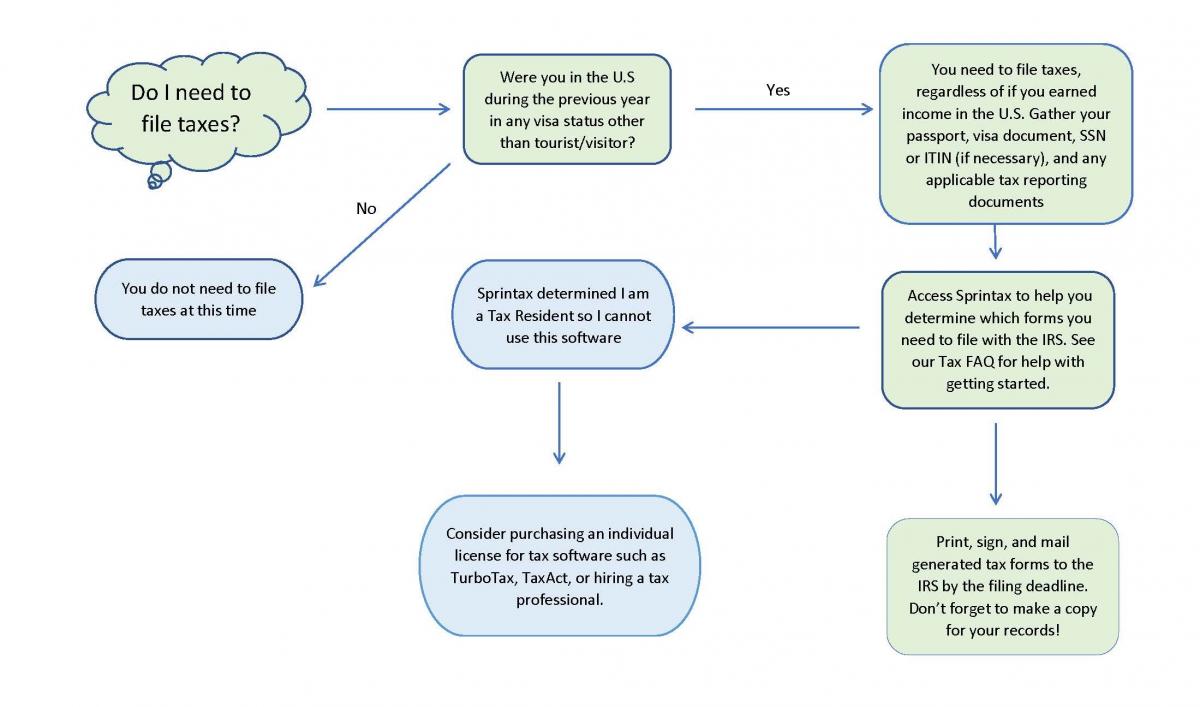

Faq For Tax Filing Harvard International Office

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

How Long Should You Actually Keep Your U S Business Records Freshbooks Blog